Property Tax Sale Arizona . the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. Arizona law provides authority for the valuation and taxation of real and personal property to fund local. the tax lien sale provides for the payment of delinquent property taxes by an investor. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. The tax on the property is auctioned in. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or.

from www.templateroller.com

the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. Arizona law provides authority for the valuation and taxation of real and personal property to fund local. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. the tax lien sale provides for the payment of delinquent property taxes by an investor. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. The tax on the property is auctioned in.

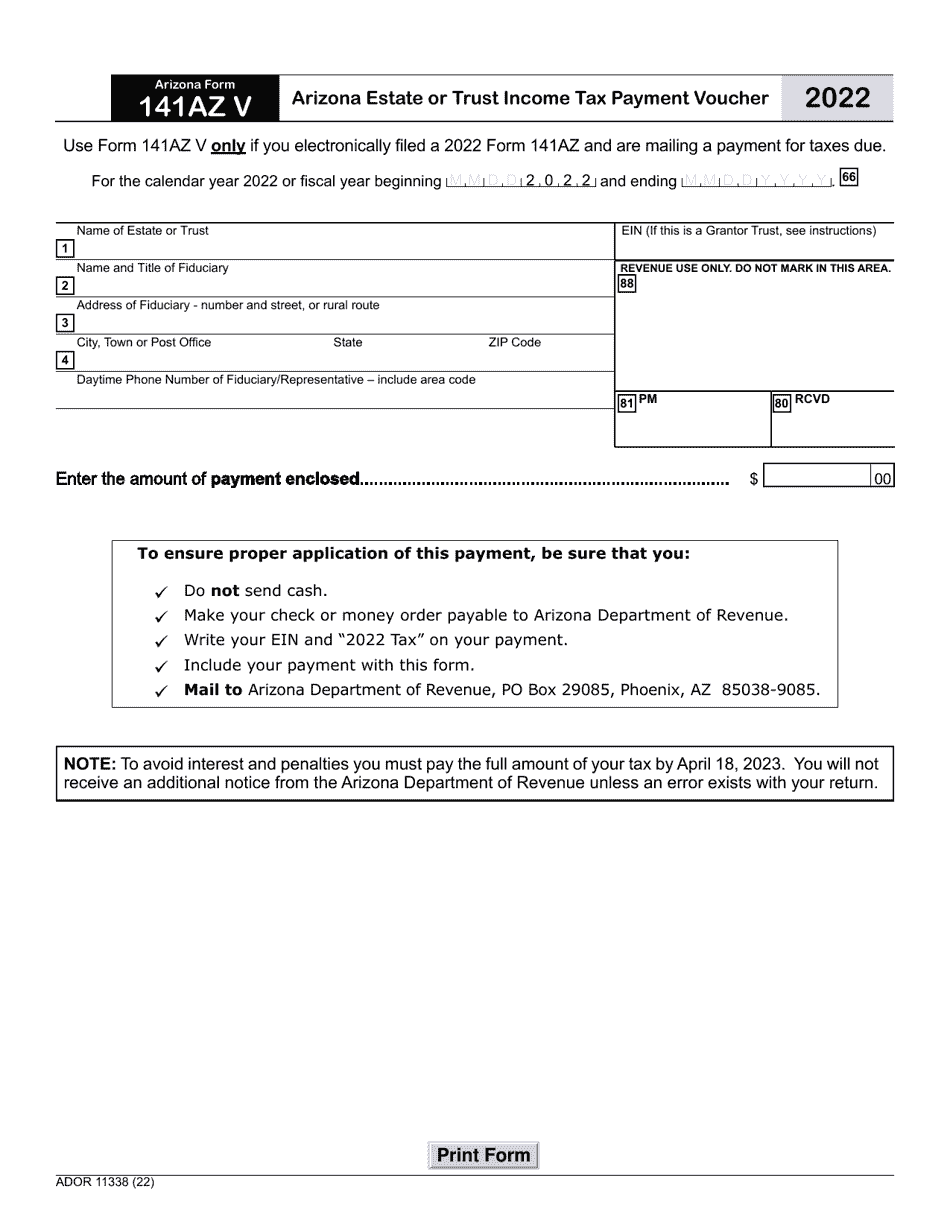

Arizona Form 141AZ V (ADOR11338) Download Fillable PDF or Fill Online Arizona Estate or Trust

Property Tax Sale Arizona understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. Arizona law provides authority for the valuation and taxation of real and personal property to fund local. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. the tax lien sale provides for the payment of delinquent property taxes by an investor. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. The tax on the property is auctioned in.

From taxfoundation.org

Combined State and Average Local Sales Tax Rates Tax Foundation Property Tax Sale Arizona form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. understand what you'll likely pay in taxes when selling. Property Tax Sale Arizona.

From freeforms.com

Free Arizona Bill of Sale Forms PDF Property Tax Sale Arizona the tax lien sale provides for the payment of delinquent property taxes by an investor. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. Arizona law provides authority for the valuation and taxation of real and personal property to. Property Tax Sale Arizona.

From www.hegwoodgroup.com

5 Common Real Estate Tax Mistakes Property Tax Consultant Tips Property Tax Sale Arizona The tax on the property is auctioned in. the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Property Tax Sale Arizona.

From www.bizjournals.com

Arizona Where sales taxes are high and property, corporate taxes go low Phoenix Business Journal Property Tax Sale Arizona the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. understand what you'll likely pay. Property Tax Sale Arizona.

From blog.turbotax.intuit.com

What are Personal Property Taxes? Intuit TurboTax Blog Property Tax Sale Arizona the tax lien sale provides for the payment of delinquent property taxes by an investor. the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february. Property Tax Sale Arizona.

From infinitelvast.blogspot.com

massachusetts estate tax rates table Boisterous EJournal Stills Gallery Property Tax Sale Arizona the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. understand what you'll likely pay. Property Tax Sale Arizona.

From azgroundgame.org

statesalestaxrates The Arizona Ground Game Property Tax Sale Arizona Arizona law provides authority for the valuation and taxation of real and personal property to fund local. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in. Property Tax Sale Arizona.

From recoveryourcredits.com

Ranking Property Taxes on the 2020 State Business Tax Climate Index American Incentive Advisors Property Tax Sale Arizona the tax lien sale provides for the payment of delinquent property taxes by an investor. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. the assessor. Property Tax Sale Arizona.

From www.realtor.com

Prescott, AZ Real Estate Prescott Homes for Sale Property Tax Sale Arizona the tax lien sale provides for the payment of delinquent property taxes by an investor. The tax on the property is auctioned in. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. form 140ptc is used by qualified individuals to claim a refundable income tax credit for. Property Tax Sale Arizona.

From www.pinterest.co.uk

USA Real Estate Agents Tax Deduction Cheat Sheet Are you claiming all your allowable Property Tax Sale Arizona understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. the tax lien sale provides for the payment of delinquent property taxes by an investor. The tax on the property is auctioned in. form 140ptc is used by qualified individuals to claim a refundable income tax credit for. Property Tax Sale Arizona.

From howtostartanllc.com

Arizona Sales Tax Small Business Guide TRUiC Property Tax Sale Arizona The tax on the property is auctioned in. the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned. Property Tax Sale Arizona.

From www.templateroller.com

Arizona Form 141AZ V (ADOR11338) Download Fillable PDF or Fill Online Arizona Estate or Trust Property Tax Sale Arizona the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. the tax lien sale provides for the payment of delinquent property taxes by an investor. form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona. Property Tax Sale Arizona.

From azgroundgame.org

Arizona’s Mismatched Budget The Arizona Ground Game Property Tax Sale Arizona the tax lien sale provides for the payment of delinquent property taxes by an investor. Arizona law provides authority for the valuation and taxation of real and personal property to fund local. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. form 140ptc is used by qualified. Property Tax Sale Arizona.

From chucksplaceonb.com

Real Estate Taxes vs Property Taxes What Are the Differences? Chuck's Place on Blog Property Tax Sale Arizona Arizona law provides authority for the valuation and taxation of real and personal property to fund local. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. the tax lien sale provides for the payment of delinquent property taxes by an investor. the assessor annually notices and. Property Tax Sale Arizona.

From www.tucsonsentinel.com

Az’s combined sales tax rate 2ndhighest in nation Property Tax Sale Arizona understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. The tax on the property is auctioned in. Arizona law provides authority for the valuation. Property Tax Sale Arizona.

From fnrpusa.com

How to Estimate Commercial Real Estate Property Taxes FNRP Property Tax Sale Arizona the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. The tax on the property is auctioned in. form 140ptc is used by qualified individuals to claim a. Property Tax Sale Arizona.

From www.pdffiller.com

2015 AZ Form 5000A Fill Online, Printable, Fillable, Blank pdfFiller Property Tax Sale Arizona The tax on the property is auctioned in. the assessor annually notices and administers over 1.8 million real and personal property parcels and accounts with a full cash value of more than. the tax lien sale of unpaid 2022 real property taxes will be held on and closed on february 6, 2024. form 140ptc is used by. Property Tax Sale Arizona.

From downloadbillofsale.com

Free Arizona Personal Property Bill of Sale Form PDF DOCX Property Tax Sale Arizona form 140ptc is used by qualified individuals to claim a refundable income tax credit for taxes paid on property located in arizona that is either owned by or. understand what you'll likely pay in taxes when selling a house in arizona, including capital gains and property taxes. the assessor annually notices and administers over 1.8 million real. Property Tax Sale Arizona.